Strategies to Increase Railway's Share in Freight Transportation

Historically, IR has been the main mode of moving freight traffic in India, almost 85% of freight traffic was transported by rail in 1950. However, this trend has seen a major reversal in recent years with the growth of the trucking industry. Although the freight turnaround has been on a rise, the share of Railways in total land freight transport has come down from 39% in 2000-01 to 26% in 2017-18 and is likely to decline in near future.

As per projections from the NRP, the share of rail declines to 23% in 2031 and increases only minorly to 26% by 2050. This is well below the NDC target of achieving 45% share of rail in freight movement by 2030. It is crucial to understand the constraints of Railways and rectify the freight management systems in order to achieve the envisaged modal share.

The reasons for decline in rail share can be summarised as under:

- Higher Transit Times

- Inadequate Handling Capacity

- Operational Inefficiency

- High Fare-to-Freight Ratio

- Absence of Attractive Policies

- Imbalanced Business Model

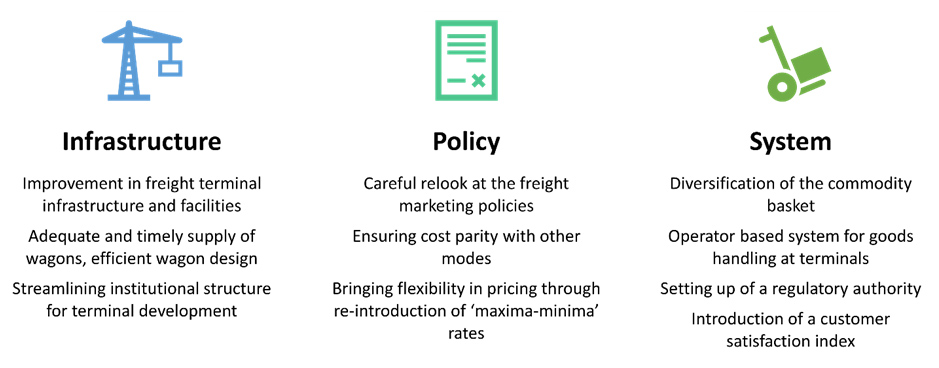

This study focuses on identifying gaps and improvements in Indian Railway’s freight business model with an aim of accelerating the model shift to railways in freight business. Key recommendations derived from the research are as follows:

Terminal Operations and Development

The overall objective of the volume is to understand the capacity constraints experienced at the freight terminals as well as during freight movement. The key area of the objective focuses on unloading terminals of IR. It aims to understand the infrastructural and operational constraints relating to freight terminals of IR. Further, it attempts to identify the issues and provide feasible solutions to optimize the freight terminal performance along with leveraging private investments for increasing terminal capacity.

Volume I: Terminal Development and Operations

Freight Marketing Policies

IR has been concerned about declining rail share in freight transport and launched various schemes from time to time. Depending upon the response from the customers; railways have made amendments in these policies. These marketing policies have had varying degree of success. The objective is divided into two sub-objectives. First, it analyses the freight performance of IR and the measures taken by them to divert freight business particularly from road. Second, it examines seven freight marketing policies; most of them initiated in last two decades, to identify gaps and challenges suggest policy recommendations for making them more attractive to achieve the objective for which they have been envisaged.

Volume II: Freight Marketing Policies

Rail Freight Tariff Policies

There are four broad objectives of this objective. First, it investigates the present freight tariff policies of IR and identifies problems within the policies. Second, it estimates the price responsiveness of the bulk commodities to infer about the impact of freight rate changes on demand. Third, it analyses the issues with the station to station (STS) rate policy which is under the domain of the zonal railways. Lastly, based on past recommendations of different committees this report suggests changes in the existing regulatory approach for increasing private participation and better assessment of tariff structure of IR.

Volume III: Rail Freight Tariff Policies

Project Team : Rahul Chakraborty, Viral Joshi, Faiz Jamal