Rooftop solar PV systems benefit power distribution companies by reducing their technical, financial and operational burden

In its commitment to renewable energy, India had set an ambitious target of setting up an additional installed capacity of 175 Gigawatt (GW) through renewable energy by 2022. Of this target, 100 GW has been apportioned for solar photovoltaic (PV), of which 40 GW has to be met through rooftop solar PV systems. There has been a dramatic growth in this sector with the falling capital cost of installation leading to solar tariffs reducing significantly over the years.

While the solar PV industry in itself has seen overall growth, the rooftop solar PV segment has seen insufficient growth in order to achieve the set target. Of the 40 GW to be installed by 2022, only around 3.86 GW had been installed by December 2018 [1].

This slow growth can be attributed to various reasons, the chief among them being some distribution companies' (Discoms) inhibition in promoting solar PV systems, fearing revenue loss. These Discoms also anticipate technical and operational challenges from such systems. Further, due to the small size of solar rooftop projects and issues of payment security, financing for these projects is not available easily.

However, the solar rooftop systems are actually quite beneficial to the very Discoms wary of them.

Managing demand

Industries, which are Discoms' highest paying customers, are already moving to open-access (mostly 'short-term' open access) system to buy cheaper electricity, irrespective of rooftop solar PV coming into the picture. Under open access, large consumers have access to the Transmission and Distribution (T&D) network to get electricity from suppliers other than distribution utilities. Discoms incurring high Aggregate Technical & Commercial (AT&C) losses due to large amount of rural/ non-paying consumers would be affected the most by this transition as they would lose a significant share of their revenue stream. Discoms also feel that the charges paid by open-access consumers are not sufficient enough (as they are exempted from certain charges) for them to cross-subsidise their low paying consumers.

If these open access consumers shift to rooftop solar PV for their electricity needs, the electricity demand of utilities would drop. The Discoms then would not need to buy expensive electricity from the open market to meet their peak demand. Thus, promoting such customers to go solar would be in their best interests.

Motivating low-paying consumers (who are mostly residential) to install rooftop solar PVs at their premises can also help the distribution utilities offset the cross-subsidy burden to some extent. Currently, this is being practiced only by some Discoms (such as BRPL, DGVCL, Torrent Power, and MPCZ) in the country. It would benefit both the consumers and Discoms, especially in areas where the solar tariff is lower than utility tariff. Ultimately, they would be able to retain all their customers.

Cutting transmission losses

Discoms' AT&C losses would be reduced with the help of rooftop solar PV systems as the power would be generated on the consumer's rooftop itself. Such systems can thus help manage peak demand during the day. They can also be utilised in meeting local demand post sunset by storing any excess energy generated, coupled with electric vehicles (EVs) and battery energy storage systems (BESS), near their premises considering the economic feasibility of such systems. They can thus help utilities reduce sudden grid loading (also known as duck-curve effect) and optimising the scheduling of costly power through power stations or power exchange, which thereby reduces their power purchase costs.

Cost savings

Rooftop solar PV systems can also help reduce commercial losses, especially among rural/ non-paying consumer categories. Additionally, such systems installed on the rooftops of consumers, who are non-obligated entities, would also help Discoms meet their renewable purchase obligation (RPO) targets and in turn claim the benefits of the same.

As there would be less power flowing through the distribution network, network congestion and loading would also come down, thereby reducing the network burden. This, too, would help the utilities defer some of their capital expenditure as the infrastructure would last longer, and reduce operation and maintenance expenditure. As Discoms are part of "pass-through" business, all the monetary benefits could be passed on to the consumers through a reduced Aggregate Revenue Requirement (ARR) and thereby, reduce utility tariff.

A sustainable business model

For Discoms to promote the use of rooftop solar PV systems and make the best use of the same, TERI proposes a 'utility-based' business model. It is based on demand aggregation and agreements between various parties, keeping the utility as the 'key-anchor' party for the implementation in their licensee areas.

The Discom can aggregate the demand for rooftop solar in their licensee area through a centralised platform and allocate the project to a developer through a competitive bidding process. The advantage of aggregating the demand would be increased project size and reduced risks of identifying locations/sites, which would lead to reduced up-front investment cost for the developer and lower electricity tariff for the consumer. A similar approach was carried out with Discoms in Delhi (BRPL [2],[3] ) and Surat (DGVCL and Torrent Power[4],[5] ).

In Madhya Pradesh, the Madhya Pradesh Urja Vikas Nigam Limited (MPUVNL) saw the lowest bid for the development of 8.6 MWp of grid-connected rooftop solar under Renewable Energy Service Company (RESCO) model. It was a record low of Rs. 1.38 /kWh[6] for central government buildings (CPSUs). This was because of the result of pre-identified locations for the project and huge subsidy (about 43% of capital cost) from central and state governments.

Through a competitive bidding process, Discoms can allocate a project with aggregated project size to a selected developer under RESCO model. They can also enter into agreements with consumers and developers respectively to ease the financial process. Based on these agreements, consumers can pay for their installed systems to the Discom, which would in turn pass this on to the developer, thus ensuring timely payments and increasing the project bankability. For this arrangement, the utility can charge a service fee and have a financial incentive to implement rooftop solar in their licensee areas.

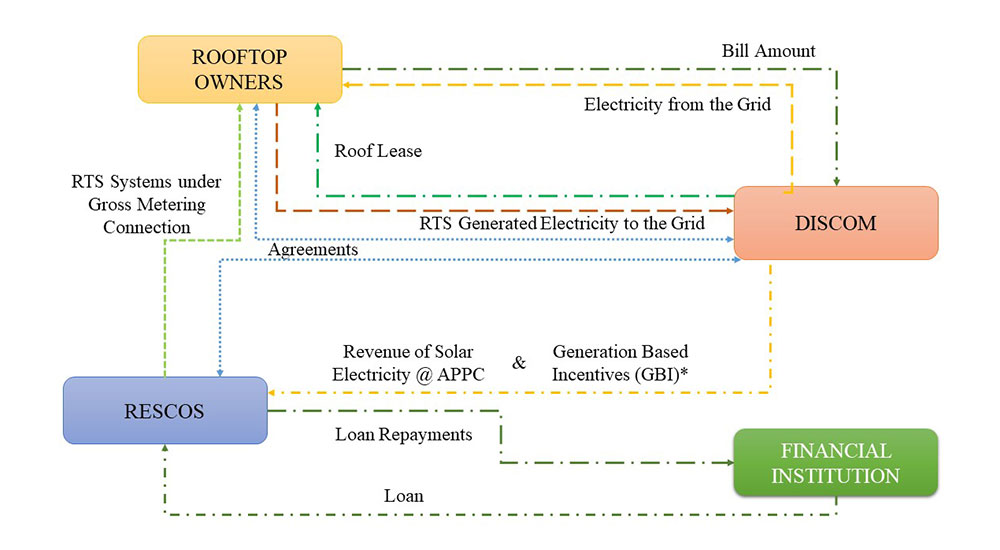

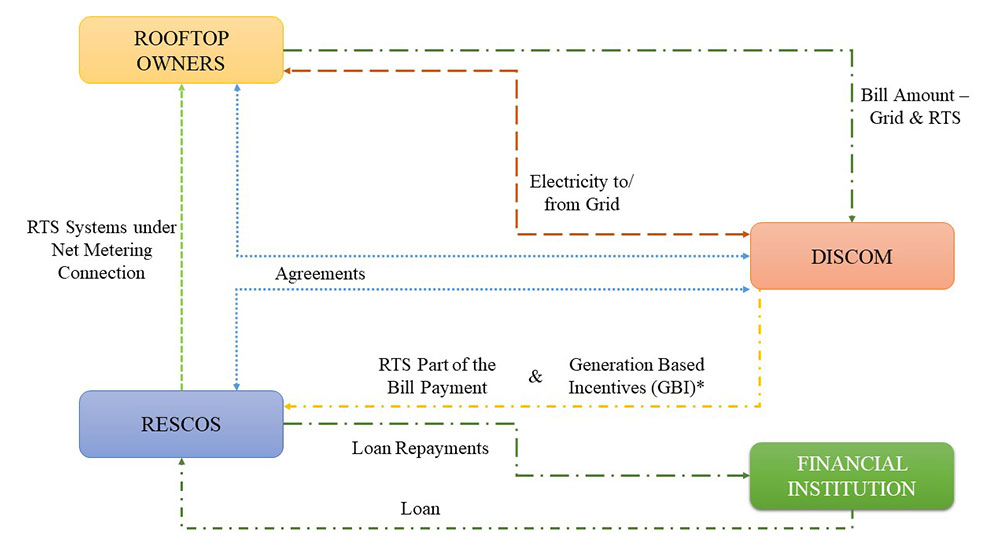

Consumers too can choose either net metering or a gross metering connection for the grid connectivity of these systems. Under a net metering connection, the power utility can bill the consumers for electricity consumed from the grid and rooftop solar system; the latter could be considered as a part of the payment for the system to the developer. Under gross metering, Discoms can bill consumers on their consumption and pay for the electricity exported to the grid; the payment for the system could be included as a part of the bill or the system can be installed on a roof-lease arrangement, where the developer or Discom make lease payment to a consumer for utilising their rooftop for a solar PV system.

Rooftop solar PV systems benefit Discoms by reducing their technical, financial and operational burden. They thus need to undertake a more anchoring role in the implementation of solar rooftop projects within their licensee areas. Looking into more innovative approaches in rooftop solar implementation, such as Discom-based business models, consumer targeted awareness, and demand aggregation can help utilities overcome any challenges faced in promoting rooftop solar. This would not only help them, but would also be beneficial to all stakeholders involved in the sector. This might provide the sector the kind of push required to achieve its targets and also avail the benefits of a clean form of energy.

[1] India solar compass Q4 2018, Bridge to India

[2] Garud, S. S. (2018, May 8). Solar rooftops: A Delhi neighbourhood takes the leap. Retrieved from The Energy and Resources Institute: https://www.teriin.org/blog/solar-rooftops-delhi-neighbourhood-takes-leap

[3] https://www.solarbses.com/

[4] Datta, A. (2018, March 7). It takes a village – Surat's united effort to embrace solar power. Retrieved from The Energy and Resources Institute: https://www.teriin.org/interview/it-takes-village-surats-united-effort-embrace-solar-power

[5] http://suratsolar.suratmunicipal.gov.in/

[6] Kabeer, N. (2018, October 5). Lowest Tariff Drops to ₹1.38/kWh in Madhya Pradesh's 8.6 MW Rooftop Solar Auction. Retrieved from Mercom India: https://mercomindia.com/l1-tariff-1-38-mp-solar-rooftop-auction/