Use of Information and Market based Instruments for enhancing Energy Efficiency in the Indian residential sector

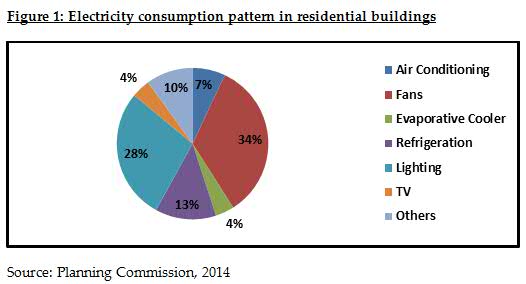

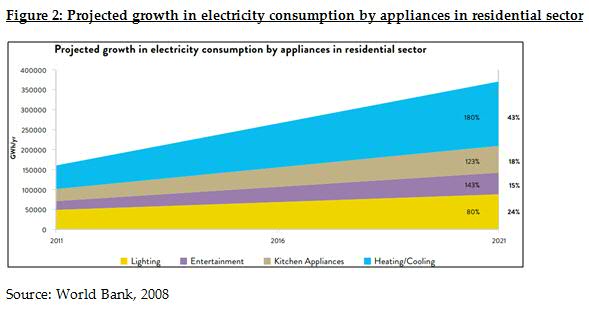

Residential electricity consumption has gone up by 50 times since 1971. Currently the residential sector consumes 24% of the total electricity consumption of India, making it second largest next to industry in terms of electricity consumption in India. Further consumption demand is expected to grow even further on account of rapid electrification, increasing household purchasing power and technology advancement. The earlier Planning Commission report estimated how different appliances contribute to the total annual residential electricity consumption in India. In this sector, lighting and cooling requirements take up 75% of the total electricity consumption, the requirements of which are projected to grow by 260% in 2021 as per World bank estimates.

Enhancing energy efficiency will be the key to keep energy demand under control and in transiting towards a low carbon future. Anecdotal evidence suggests that in general, Indian consumers are relatively more cost conscious than their western counter parts. The large majority of individuals - mostly, middle and low income - promptly switch off appliances (e.g. lights, ceiling fans, television sets, etc.) when not in use. Consequently, one would expect that higher adoption of energy efficiency technology is more likely to happen in India than in the west. However, the market penetration of energy efficiency is hampered by several barriers in India that are influenced by high upfront costs, heavily discounted future savings, uncertainty associated with energy savings, lack of access to capital, lack of awareness and the inability to assess the lifetime benefits and costs of the decision. In particular, information a symmetries leading to market failures may be a key bottleneck to the faster adoption of energy efficient solutions in India.

Electricity Act of 2003 provides an overarching framework for enhancing energy efficiency in the residential sector. The government has promoted energy efficiency through initiatives such as standard and labeling scheme, outreach activities, incentives for adopting and manufacturing energy efficient appliances (Bachhat Lamp Yojana Scheme, Super-Efficient Equipment Programme-SEEP) and voluntary building codes (with Energy Conservation Building Code-ECBC made mandatory for commercial buildings). Occasionally, it has implemented DSM pilot programs targeted towards accelerating adoption of energy efficient appliances. However, in spite of the large potential and existing efforts to foster energy efficiency in the residential sector, much remains to be achieved.

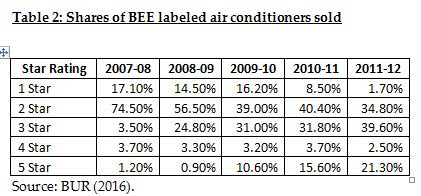

Bureau of Energy Efficiency (BEE) recently estimated potential savings made from the star labelling scheme of four common energy consuming appliances in households (ACs, ceiling fans, refrigerators, colour TVs) using national sample survey office (NSSO) data. From the labeling of these four appliances, the estimated saving of electricity consumption by households in the year 2030 is 136.8 billion units (or 24%). BEE has stipulated a reduction of approximately 30% for house hold electricity consumption, inclusive of both lighting and appliances for the year 2030.However if we look at market shares of BEE labeled appliances continues to be abysmally low.

This clearly depicts a case for accelerating the market penetration of energy efficient appliances. Moreover with BEE periodically revising (tightening) energy efficiency standards, the role of information and market based instruments becomes extremely critical in acting as the driving force for consumer to switch to more energy efficient appliances as the technology updates. Recently, the Bureau of Energy Efficiency (BEE) has introduced a new star rating methodology called Indian Seasonal Energy Efficiency Ratio (ISEER) for air conditioners such that, the Star-5 in 2010 became Star-3 in 2015 and will become Star-1 in 2018 as per new ISEER methodology. With this background it becomes necessary to calculate the payback period given the useful lifetime of appliance, high upfront costs and high discount rates of customers before designing the tailored information and market instruments targeted across expenditure classes.

Information based instruments can generally be classified as direct and indirect feedback from energy suppliers on household's energy consumption and interventions targeted for greater penetration of energy efficient appliances and technologies. Direct feedback covers information on real time consumption provided on internet or through dedicated devices and displays, including mobile devices via smart meters. Providing real time energy consumption information may allow a prompt response from the final energy consumers and increase energy savings. Indirect feedback could include more informative and frequent bills containing historical and/or comparative information on energy consumption. It uses instruments of energy certificates, energy audits, information on energy use and energy efficiency, community based marketing, peer comparisons, target setting, etc. These instruments have been widely used across the United States and by various European Union member states. Energy savings due to direct feedback generally fall within the range of 5% to 15% whereas energy savings from indirect feedback can reach 10%, but success depends on the context and the quality of information delivered to households.

Countries have also been using fiscal incentives and subsidies for encouraging sustainable household energy investments. For instance, Ontario, Canada, Italy and UK provides rebates on provincial sales taxes for purchases of select energy-saving appliances and replacing outdated energy intensive products. Germany offers interest-free ten-year loans as well as a guaranteed price for house hold solar heating installations. Recently Japan has deployed a 'Green loyalty point system' to promote low carbon lifestyles by encouraging consumers to buy energy efficient appliances. Consumer gets awarded with reward points whenever they buy energy efficient appliances which can be redeemed for discounts on public transportation, basic utility charges, and purchases of other efficient appliances. The program had been a huge success in Japan, with shares of products that had four or more stars increased from 20percent to 96 percent for air conditioners, from 30percent to98 percent for refrigerators, and from about 84 percent to 99 percent for televisions. This resulted in estimated savings of 2.7 million tons of CO2 per year. Other Countries running similar programs include South Korea, Netherlands and France.

Similar to this, DISCOMs in Delhi and Mumbai have launched an appliance exchange programme wherein they offered their consumers a substantial rebate (to the tune of 40-50%) for replacing their old inefficient appliances with new 5-star rated appliances. However,the programmes have remained at the pilot scale as scaling up these programs will require significant budget outlays and can have a substantial tariff impact especially for the non-participating consumers who cannot avail of the benefits from energy-efficient appliances. Also, one of the major barriers DISCOMs faced is the lack of availability of 5-star rated products which comply with the latest standards, which creates uncertainty among the consumers regarding its performance and potential energy savings.

Information based instruments and market based incentives would work to change or alter the behaviour of Indian consumers regarding energy consumption and drive them on the path of energy efficiency and conservation. Further since behavioural change is seen as a combination of both conscious effort and habitual behaviour; therefore it is essential to develop innovate marketing campaigns to trigger the right impulse for example for impacting decision on energy consumption some questions need to be raised and answered like how energy is used (intensity & mode), what appliances to buy or upgrade, why buy star rated appliances and many more. Specific actions needs to be developed to turn them into new routines or habits which would then influence their long term behaviour.

In our view market based instruments such as green loyalty point system, interest free EMI option on purchase of energy efficient appliances are likely to work in India's context. Similarly quantifying monetary benefits of energy units along the star rating label might address consumer misconceptions. Thus tailored information strategies could solve problems of imperfect information in markets by disclosing the unobserved costs of individual consumption decisions to consumers. Moreover, because electricity demand is relatively price inelastic, non-price information strategies using normative, intrinsic, or social motivations might prove effective alternatives.

Thus it needs to be acknowledged that behavioral and non-price incentives would be a key factor as far as energy conservation is concerned where as monetary or fiscal incentives would be required for accelerating market penetration of energy efficient products, which underlines the salience of a mix of fiscal and information-based instruments to target improvements in energy efficiency in Indian households.