India faces a huge challenge in coal transition today—transitioning entire regions and districts, finding livelihood opportunities for a population the size of smaller countries, and meeting our development and climate goals. The scale and size of this transition alone makes it unprecedented in the history of coal transitions across the world. In this article, Swati Dsouza and Kavya Singhal discuss the ways in which socio-economic fallouts of coal transitions in India could be mitigated.

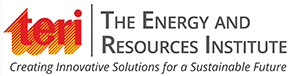

Coal transitions in India are likely to be a messy and complicated exercise. A recent study by Dsouza and Singhal (2021) found that at conservative estimate, more than 13 million people (Figure 1) are employed in coal mining, transport, power, sponge iron, steel, and bricks sectors. This is more than the population of at least 160 countries around the world, or the population of a country such as Zimbabwe. This figure does not include those in the informal sector in coal mining, labour involved in coal imports (at the ports or transport from ports to thermal plants), indirect activities in the iron and steel sector including third party sellers, warehousing staff, iron ore mining, etc., and also the dependents of workers or even third party vendors such as equipment manufacturers. Conversations with stakeholders suggest that only including the informal coal economy would likely take this dependency to more than 20 million people or the population of Sri Lanka.

If one were to exclude the bricks sector (which is mostly informal and the numbers fluctuate year on year), the number of people dependent on coal would still be around 2.5 million people. Of the 1526 sponge iron and steel units producing crude steel, 610 or 40% is situated in the four states of Odisha (12%), Jharkhand (9%), Chhattisgarh (10%), and West Bengal (9%). Of the 229 thermal power plant units (including captive), 40% are located in Uttar Pradesh (12%), Chhattisgarh (10%), Maharashtra and Madhya Pradesh (9% each). Coal is mined across eleven states in India, with four states—Chhattisgarh, Jharkhand, Odisha, and Madhya Pradesh—accounting for ~80% of the 730 million tonnes (MT) of production (CCO, 2020). These states will be the most affected in the coming decades when India transitions away from coal to meet the net zero target in 2070.

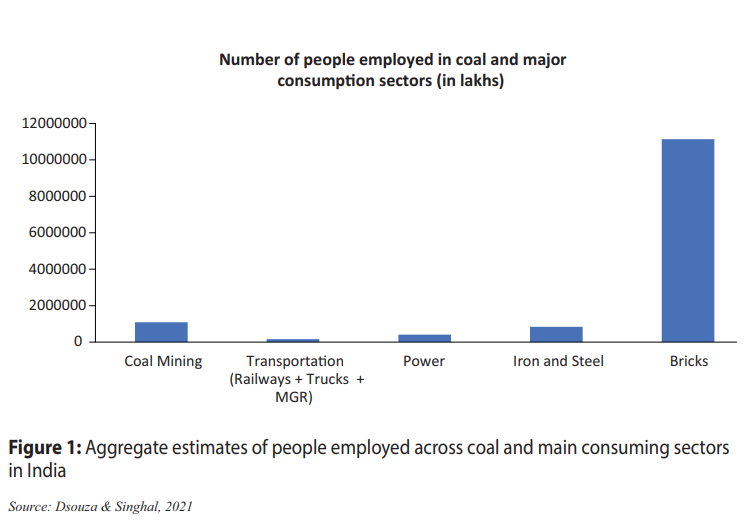

Coal transitions are likely to have the most impact on the people in the central and eastern states of West Bengal, Jharkhand, Chhattisgarh, Odisha, and Madhya Pradesh, with some parts of Uttar Pradesh, Telangana, Maharashtra, and Andhra Pradesh. At the national level, 266 districts have at least one asset linked to the coal sector, and 135 of these 266 districts have two or more assets dependent on coal, i.e., a coal mine, thermal power plant, sponge iron plant, steel plant. At least half of all the districts in Jharkhand (15) and West Bengal (11), 30% of districts in Odisha and Chhattisgarh (9) are likely to be impacted in some form or the other due to the impending coal transitions

This is the real challenge that India faces today. Transitioning entire regions and districts, finding livelihood opportunities for a population the size of smaller countries, and meeting our development and climate goals. The scale and size of this transition alone makes it unprecedented in the history of coal transitions across the world.

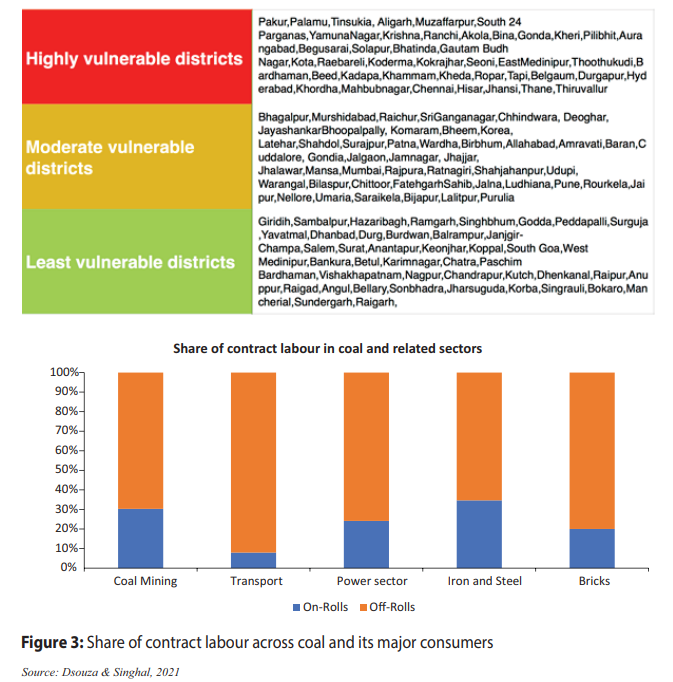

Characteristics endemic to the Indian market complicates this transition process further. These include the large presence of contract/off-roll labour in every sector, the socio-economic profile of the labour in the sectors, and the overall sectoral roadmaps. The share of off-roll labour accounts for at least 70% of the total labour across all sectors, reaching as high as 92% and 80% in transport and bricks, respectively.

Official labour estimates in different sectors do not account for this labour since they are employed by job contractors. Without their inclusion from the get-go, it is likely that they may not be beneficiaries of the transition policies and the costs of transitioning them will be discounted. The informality limits institutional support mechanisms like unions. The coal transport by road, for example, is the most vulnerable to the transition given increasing mechanisation, and probably the first to be impacted, but lacks a union or other institutional mechanism to make a case for them as coal transition workers. The brick sector may not even be viewed as a coal transition sector, given the labour is employed for 6 months in a year, is migratory by nature and, therefore, there are no official records on the number of people employed in the sector or a platform for the labour to be a part of the discussion. Figure 3 shows share of contract labour across coal and its major consumers.

No official dataset captures the socio-economic profile of the labour employed in these sectors. Capturing socio-economic profiles becomes necessary while designing policies on retraining and reskilling, since the baseline differs between sectors, and even within different job profiles in the same industry. The Periodic Labour Force Survey (PLFS) studies broader dynamics of the labour market, but the intent of the survey is not to ascertain socio-economic indicators within particular sectors. Nevertheless, it is the only available official dataset to understand labour patterns. Using the PLFS dataset, the study identified key socio-economic indicators such as education, wages, training, gender split, job contracts. The results are endemic of the larger trend in the Indian labour market. Eighty-one per cent of the labour force in India is employed in the informal sector/shadow economy (with no social benefits) and if one were to include the portion of informal sector workers (contract/casual labourers), then the proportion is as high as 92% (Punia, 2020). As Mehrotra (2019) has detailed one of the reasons for growth and informal economy has been low education and skill levels of the workforce. This trend is captured in Figure 4 for coal and its major consumers. Mirroring broader national labour trends, women fare worse off than men across most coal-dependent sectors. Low education and skill levels and high informality will be barriers to transition. Low education levels enable information asymmetry since the labour who is likely to be transitioned is not informed of their rights. Further, the technical nature of the green industries necessitates targeted reskilling and training programmes, without which a just transition will be difficult to achieve in India.

The third complication is the trend of the broader sectoral roadmap. National-level trajectories and policies on sectoral roadmaps are not yet aligned with the impending coal transition or with the recently announced net zero target. This prevents future planning and investments for a post-coal world. Some sectors like the Indian Railways are heavily reliant on coal, with ~44% of their revenues coming from coal. In our conversations with stakeholders, the roadmap for railways remained unclear in a post-coal world. Freight revenues are important since they help bridge the gap in operational cost of passenger movement. The coal sector itself has been undergoing an expansion with recent reforms in commercial coal mining and auctioning of new coal blocks. Coal India has only recently announced plans for diversification, but these are limited forays in solar and possibly aluminium production. Despite 112 mine closures since 2008, there is very little evidence of environment remediation and land rehabilitation in these areas. In the power sector, until very recently (August 2021) there were no guidelines on plant decommissioning and environment remediation. In iron and steel, there are some indications that the sector will have to undergo a consolidation (98% of the industry has plants with less than 1 MT capacity), since not all firms have the capital to transition to new technology. However, it is still not clear the technology pathway the sector is likely to undertake. A pathway that chooses electrification, hydrogen or natural gas or any low-carbon technology will necessitate retraining and reskilling. It will also result in retrenchment of the contract labour that is involved in coal handling.

But a well-planned transition and advance planning can take care of most of these challenges. The transition will necessitate aligning state, national and sector roadmaps at the planning level. Strategies towards decarbonization cannot be undertaken with simultaneous investment and expansion of the coal sector and its allied uses. This will impede investments needed to meet the net zero target and continue the carbon lock-in with possibilities of stranded investments. Further, India needs to define a coal transition worker across different sectors with targeted emphasis on contract/informal labour and their socio-economic profile. Without this it is possible that a significant chunk of the labour force will not be beneficiaries of the transition policies. Accounting for the contract labour force also helps accounting practices as India needs to determine the financial and economic costs required for the transition. Environment remediation and decommissioning or closure plans have to become a necessary component for all sectors with increased capacity at the central and state level for their monitoring and implementation. Without this, it will be impossible to design strategies for economic regeneration in the 135 likely to be impacted districts. These coal bearing regions will need to be made productive again through regional strategies. The current governance structure is unlikely to yield results for the transition. Decision making for energy is concentrated at the central government level, while planning and implementation of the resulting challenges (labour, education, health, etc.) is the purview of the states. This leads to an imbalance since revenues are accrued more to the central government than state governments. This structure needs to be corrected. Centre-state councils like the GST Council can help bridge this imbalance. Lastly, India will need to communicate at the global level about the scale of these transitions and demand climate finance to manage and implement the strategy. Without external funding, it is unlikely that the scope of the transition only on livelihoods can be met solely by domestic funding. Multilateral Development Banks will need to de-risk coal bearing areas during the transition period to facilitate green investments. In the short term, funds from the District Mineral Fund can be leveraged. Domestically, the country will also need to prepare its financial system for early closures.

Finally, all stakeholders have a role to play in this transition roadmap. District authorities become the focal point of the transition roadmap since they are the key implementors and the first point of contact for local resistance or support. Industries will need to be brought on board for their input on district-level investments and preparing the transition strategy for the existing force. The existing labour force will have to be bucketed into categories of those who can be voluntarily retired (and the financial cost of this), those that can be transitioned within the same company and or another similar profile in the same area. Labour unions have to become a necessary part of this conversation since they will essentially be the communication bridge between the management, governments, and the larger labour force. In sectors with no unions, it is incumbent upon local authorities to seek an ‘influencer’ or group leader to lead the discussions. Local and community leaders will have a big role to play in this transition. They are essentially entrenched in the existing political economy and without their support, local resistance may increase. Therefore, their influence needs to be cultivated for the success of this transition strategy through involvement in district- and state-level planning.

The next steps highlighted here determine near-term strategies while we prepare for the broader transition. All efforts have to be made to not only transition the existing work force, but also put in place strategies that will prevent future generations from working in coal and related sectors.

Coal Mining

A mine-wise estimate of reserves: Given a target date of net-zero by 2070 and endorsements on clean technology, typically, the big and other mines which produce 85% of the coal in the country will likely be the ones running for the next 20–30 years. Most underground mines and rest of mines will likely be shut down within this decade. Preparing a timeline of mine closure will be most effective using the reserve estimates.

Analyse the trend of contract workers in every mine over a five-year period. This will help identify the actual employment provided by the mine in the district/area. A mine-wise estimate will help quantify and codify contract workers as formal coal transition workers. Job contractors are mandated by law to register their workers with the labour commission.

Identifying socio-economic characteristics like age, education, technical qualification of workers in underground mines since they will most likely be shut down earlier. This will help prepare a plan to retire/transition workers. This should be followed by an assessment of workers in rest of the mines since they will be the next ones to be shut down. Here as well, it will be prudent to begin with the mines, which are almost exhausted or producing the least amount of coal.

Based on the socio-economic characteristics, delineate the extent of financial aid that will be required in every mine area for retrenchment, early retirement and retraining the existing workforce. This can be useful if India decides to follow South Africa’s strategy and seek global aid. At COP26, South Africa sought and will receive an initial amount of USD 8.5 billion from the US, UK, Germany amongst other countries to end its reliance on coal (Mkhize, 2021).

Prepare and implement environment remediation: While a 2012 guideline (Ministry of Coal, 2012) document on mine closures has been notified by the Ministry of Coal, there is no evidence that this has actually been implemented in practice. Between 2008 and 2018, 123 collieries owned by CIL and SCCL have been shut down. However, there is little evidence of a robust transition in these areas.

Coal Transport

For the truck segment, the next steps are more or less covered under the coal mining category. Perhaps, it might be useful to identify the extent of debt amongst households in the district on HEMMs (trucks, etc.). This will have to be added to the financial cost of transition, since eventually it may lead to a payoff.

For Indian Railways, there is a need to diversify its revenue sources. It is also imperative that they be a part of the mine closure roadmap, since closures will have a direct impact on the railway staff in coal bearing divisions.

Power Sector

The first step towards a smoother transition should be to identify plants, which are likely to be shut down in this decade. Germany, for example, is holding auctions whereby plant owners are incentivized to shut down a plant earlier. This has to be coordinated with mine closures timetable, a closure of both assets in the same or nearby districts is likely to impact economic parameters for the district and households within the district.

Workers, unions need to be a part of this conversation. Without their inputs, it is unlikely that the transition will be smooth, and their involvement will also mitigate fears of job loss.

Thereafter, it is necessary to categorize the age, skill level, and other socio-economic parameters of workers within these plants. This will help identify workers who can be provided with early retirement packages, those who will need to be transitioned to other local power plants and those who may be retrenched.

This assessment will need to include contract workers since they are about 70 per cent or more of the workforce in the plant. If there is no external mandate, then it is likely that job contractors will move on, leaving contract labour stranded in the district.

The sites of these plants will need investments for environment remediation and land rehabilitation, especially at the CHP and AHP sites (ash ponds, coal storage areas, etc.) before they can be utilized for other economic activities. It is necessary to assess these individual areas, analyse the necessary investment, demarcate finances, and identify appropriate funding sources. While the NGT order and the resultant draft guidelines provide a framework, these are yet to be approved. Moreover, these guidelines do not include impact on livelihood.

At a minimum just these few steps are likely to take a decade to materialize. Therefore, even if India and the power sector does not expect early retirements, it will be imperative to begin the process of transition planning today.

Iron and Steel Sector

It is imperative for the Government of India to begin the conversation on moving towards natural gas or alternate fuels for the coal-based DRI industry. This will help reduce emissions from the sector and prepare them for the eventual transition.

Supplementing this exercise, it is necessary to identify if the labour force can be transitioned in its existing form or if training programmes have to be conducted.

Irrespective of the technology, it is clear that coal usage is expected to decrease in the next two decades. This will impact workers on the coal supply chain in this sector and they should be considered as coal transition workers under the broader transition programme.

Districts with smaller-sized units that are expected to see consolidation should be mapped alongside power plant and coal mine districts. This will help identify districts most vulnerable, i.e., if all three assets are in the same district.

Bricks Sector

Geotag kilns across the country to help fix the location of the kilns. This exercise has to be updated on an annual/bi-annual basis and will help provide information on the number of kilns.

Incentivize kiln owners financially to adopt efficient electricity-based technology.

Enforce environment pollution norms that will make it easier to incentivize transition and identify unregistered kilns.

Make it mandatory for job contractors to submit labour data to the local labour commissioner’s office every year. Once this has been done for a few years, it will help create a labour database for the brick sector. This information will also help identify socio-economic characteristics of the labour.

Create a cadre of workers who will be able to train new labour every year ahead of the brick making season.

Enforce minimum wage rules to improve socio-economic conditions of the labourers.

Swati Dsouza works as Research Lead – Climate change at National Foundation for India, New Delhi and Kavya Singhal works as Research Associate - Climate Programme at National Foundation for India, New Delhi.

This article and more from Energy Future can be viewed here: https://bookstore.teri.res.in/energyfuture