One must look beyond just upfront cost and also consider life cycle economic assessment when evaluating the cost of battery energy storage systems

With the gradual emergence of energy storage markets, it has become all the more important to gain clear and unbiased insights into the economic performance of different storage technologies. In many countries including India, distribution utilities grapple with overloading of distribution equipment, upgrading additional distribution systems, renewable energy (RE) integration cost, and purchasing expensive power to meet peak demand. RE sources and a roadmap towards low-carbon pathways for the transportation sector through targeted deployment of 30% electric vehicles in the total fleet by 2030 could also contribute to changing demand profile with increasing peak demand. Therefore, it becomes imperative to evaluate battery energy storage systems (BESSs) as a plausible solution to existing operational and technical problems in electricity distribution networks.

Despite batteries’ falling prices, their high upfront cost is looked at as an impediment to large-scale deployment. However, life cycle economic assessment of any battery storage system is important before arriving at any conclusion. Plausible revenue streams should be evaluated against Levelised Cost of Storage (LCOS) to arrive at an appropriate cost-benefit inference rather than evaluating evident benefits against upfront cost.

Levelised Cost of Electricity (LCOE) is the average price of electricity over time considering specified financial returns. LCOS is on similar lines and can be adjudged on average storage cost over a period of time in terms of time value of money.

To maintain the operation of distribution equipment within permissible loading range, peak shaving using a BESS provides an alternative solution to upgrading associated equipment. In peak shaving, BESS stores electricity during off-peak times and supplies it to consumers during peak demand.

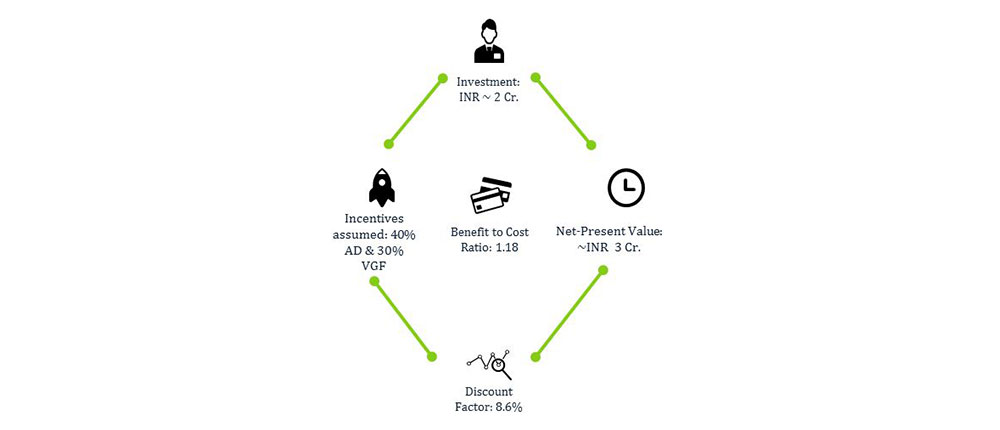

To demonstrate peak shaving as an application, among others things, TERI is conducting a pilot study of BESS at a selected distribution transformer (DT-level) within the licensee area of BSES Rajdhani Power Limited (BRPL) in Delhi under UI-Assist initiative. A prima facie cost-benefit analysis was performed on the pilot with the following assumptions:

System Design Assumptions

| Parameter | Values | Units | |

| Designed energy capacity | 334 | kWh | calculated as per system efficiency |

| Designed power capacity | 107 | kW | as per project requirement |

| Plant life | 14 | Years | as per battery manufacturer for a cycle per day |

Technical Assumptions

| Parameter | Values | Units | |

| Depth of discharge | 90% | % | as per battery manufacturer |

| System efficiency | 90% | % | as per battery manufacturer |

| Auxiliary consumption | 5% | % | as per learning from pilots |

| SOH (State of Health) | 95% | % | as per battery manufacturer |

| Life in number of cycles | 5,000 | Closest assumption | |

| Number of cycles per day | 1 | Closest assumption |

Results of the same can be represented as below:

Inferences drawn

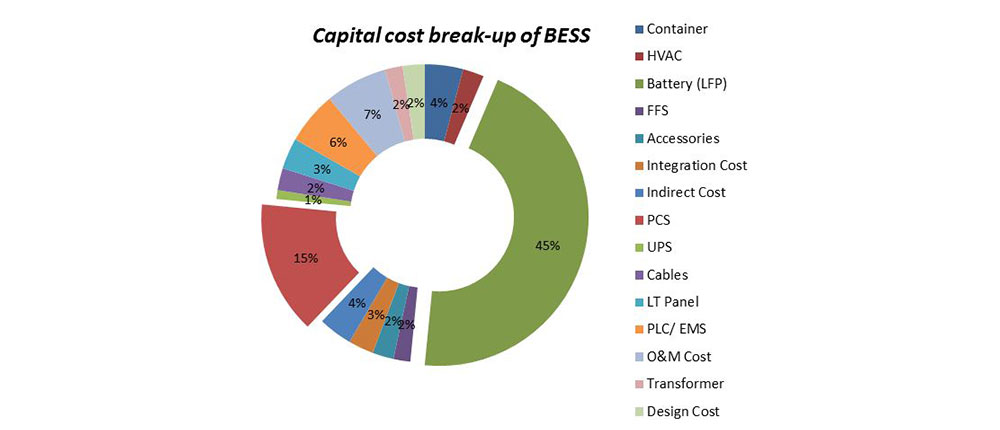

Capital cost of BESS includes various costs other than that of battery packs. The capital cost can be broken as under:

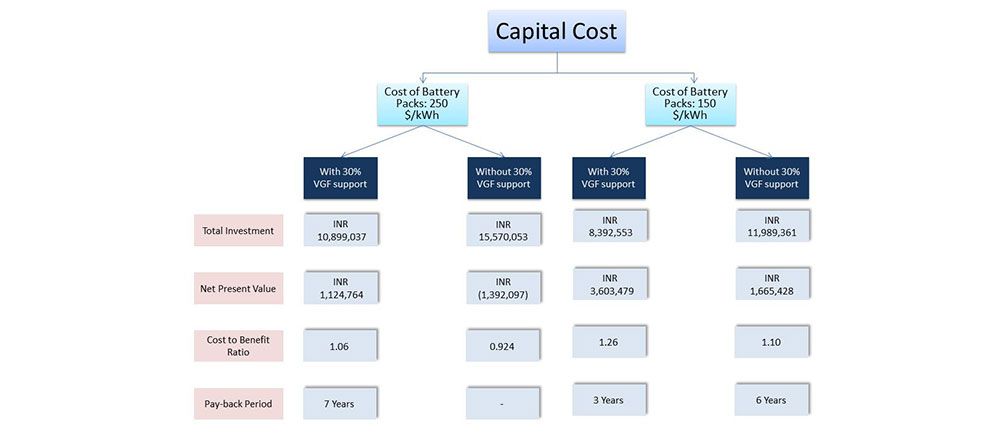

A major chunk of capital cost falls under the segment of battery packs and power electronics. Some other costs associated to BESS are O&M costs, fire-fighting system cost, HVAC cost, integration cost etc. The cost-benefit analysis of BESS depends on various factors such as BESS application, technology, government support towards technology implementation (through Viability Gap Funding and associated funds), land availability (whether taken on lease or purchased) and other location-specific factors. Hence, a case based approach to perform cost and benefit analysis (CBA) should be adopted for more accurate results. Battery prices are continuously falling; therefore, it is essential to compute results under present and envisaged future cost after two to three years.

Different cases and results under each scenario are presented below:

Conclusion

The renewables industry these days tends to reward technologies with the lowest investments as it is seen as translating to lowest levelised cost. In this scenario, rewarding low investment technologies may hinder deployment of BESS due to high upfront costs.

However, low investment technologies may not always deliver the greatest value. A better way to appreciate the actual value of battery energy storage is to arrive at a specific application and then explore possible services that can be offered side by side under the identified application.

These services will act as revenue streams other than primary services offered by BESS. For example, peak shaving at downstream of distribution network will defer distribution upgrades. Here, BESS can also be utilised to manage load during peak hours, thus also saving on expensive power purchase during peak hours. It is also important that studies evaluating BESS are not examined in geographic isolation as the local energy market and price signals critically determine the revenue available for each of the identified services. More system integration approaches and evaluations are needed to add to the knowledge base.

Since BESS is a customised solution, CBA may differ from location to location and application to application. Different battery technologies offer different technological characteristics like power density, energy density, C-rates etc. A suitable technology is chosen based upon pain areas of the distribution network. Different technologies are available at a different price in the market. Moreover, loading patterns and envisaged change in demand profile also contribute to kW rating of power electronics and kWh rating of battery packs. Plausible revenue streams are also dependent on the price signals of the specific region where BESS is located.

Therefore, no standard cost of service or levelised life cycle cost can be attributed to a BESS at this stage. A BESS project with high upfront investment may offer services at low rates and a BESS project with an average upfront investment may offer services at expensive rates.

Hence, the need of some pilot projects in various regional locations is evident to arrive at a concrete supposition and to prepare discoms for anticipated operational challenges, including demand profile changes accompanying the paradigm shift towards cleaner and greener technologies. Pilots may be dedicated to different applications with different combination of OEMs with varied experiences in order to gain sufficient understanding of technology ecosystem to arrive at closer assumptions. Moreover, pilot projects will also help in understanding any operational challenges of BESS, if any.