Page 2 - Tax Regime for Improved Cookstoves and Its Implications

P. 2

TERI Policy Brief

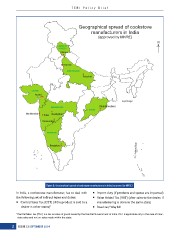

Geographical spread of cookstove

manufacturers in India

(approved by MNRE)

N

HIMACHAL

PRADESH

Sirmour

New Delhi

UTTAR PRADESH

Faizabad

GUJARAT

Anand

Bay of Bengal

MAHARASHTRA Bhubhaneshwar

ODISHA

Nav Mumbai Pune Aurangabad

Osmanabad

KARNATAKA

Bengaluru

Figure 1: Geographical spread of cookstove manufacturers in India (approved by MNRE)

In India, a cookstoves manufacturer, has to deal with Import duty (if products and spares are imported)

the following set of indirect taxes and duties: Value Added Tax (VAT) (after sales to the dealer, if

Central Sales Tax (CST) (if the product is sold to a manufacturing is done in the same state)

dealer in other states)1 Road tax/ Way bill

1 C entral Sales Tax (CST) is a tax on sales of goods levied by the Central Government of India. CST is applicable only in the case of inter-

state sales and not on sales made within the state.

2 ISSUE 13 SEPTEMBER 2014

Geographical spread of cookstove

manufacturers in India

(approved by MNRE)

N

HIMACHAL

PRADESH

Sirmour

New Delhi

UTTAR PRADESH

Faizabad

GUJARAT

Anand

Bay of Bengal

MAHARASHTRA Bhubhaneshwar

ODISHA

Nav Mumbai Pune Aurangabad

Osmanabad

KARNATAKA

Bengaluru

Figure 1: Geographical spread of cookstove manufacturers in India (approved by MNRE)

In India, a cookstoves manufacturer, has to deal with Import duty (if products and spares are imported)

the following set of indirect taxes and duties: Value Added Tax (VAT) (after sales to the dealer, if

Central Sales Tax (CST) (if the product is sold to a manufacturing is done in the same state)

dealer in other states)1 Road tax/ Way bill

1 C entral Sales Tax (CST) is a tax on sales of goods levied by the Central Government of India. CST is applicable only in the case of inter-

state sales and not on sales made within the state.

2 ISSUE 13 SEPTEMBER 2014